Did you know you can get up to $11,750 back on the purchase price or lease of a new electric or hybrid plug-in car?

There is no better time to consider electric if you are in the market to purchase or lease a new car than right now. The two types of cars that qualify for EV rebates are fully electric and also hybrid plug-in vehicles. With the purchase of either of these types of vehicles you can get up to $7,500* federal tax credit in addition to a state rebate. The state rebates are as follows:

- $2,000 NYS tax rebate*

- $2,500 Massachusetts tax rebate*

- $4,250 Connecticut tax rebate*

New York EV Tax Credit

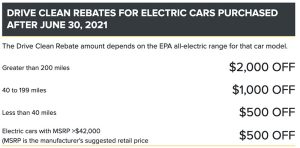

In New York State the Drive Clean Rebate offers NYS residents a rebate that is dependent on how much battery-only range the vehicle has and the purchase price of the vehicle purchased or leased, see below:

Massachusetts EV Tax Credit

The MOR-EV program offers Massachusetts residents who purchase fully-electric battery cars with a purchase price of less than $50,000 a rebate amount of $2,500. For plug-in hybrid vehicles with a battery range of 25 miles or more and a final purchase price less than $50,000, consumers will receive a $1,500 rebate.

Connecticut Tax EV Credit

The CHEAPR (Connecticut Hydrogen and Electric Automobile Purchase Rebate) gives up to $4,250 depending on the type of vehicle leased or purchased. For fully-electric cars the incentive amount is $4,250, and for plug-in hybrid vehicles (PHEV) the rebate amount is $2,250.

Cars That Qualify for the Federal Tax Rebate

Image Courtesy of Hyundai

Hyundai cars that qualify:

2022 Ioniq 5

2022 Tucson Plug-in Hybrid

2022 Santa Fe Plug-in Hybrid

Image Courtesy of Jeep

Jeep cars that qualify:

2022 Wrangler PHEV

Jeep Grand Cherokee PHEV

Image Courtesy of Nissan

Nissan cars that qualify:

2022 Leaf

Image Courtesy of Toyota

Toyota cars that qualify**:

2022 RAV4 Prime Plug-in

2022 Prius Prime Plug-in Hybrid

Take advantage of these programs and find your electric or plug-in hybrid here: https://www.liacars.com/searchnew.aspx

Please note on August 16th 2022 there are new tax requirements for qualifying electric vehicles... Final assembly is now required to have occurred in North America.

More information Here: Plug-in Electric Drive Vehicle Credit Section 30D | Internal Revenue Service (irs.gov)

Use this link to look what vehicle qualifies for Tax credits: Alternative Fuels Data Center: Inflation Reduction Act of 2022 (energy.gov)

*Tax credits are based on current data from 8/9/2022 and are not guaranteed and are subject to change based on government programs.

**Any Toyota vehicles purchased after 9/30/23 will no longer be eligible for federal tax credits.

Sources:

https://www.fueleconomy.gov/feg/taxevb.shtml

https://www.nyserda.ny.gov/drive-clean-rebate

https://www.mass.gov/service-details/state-and-federal-electric-vehicle-funding-programs

https://portal.ct.gov/DEEP/Air/Mobile-Sources/CHEAPR/CHEAPR---Home